Access Your Free Credit Score & Report

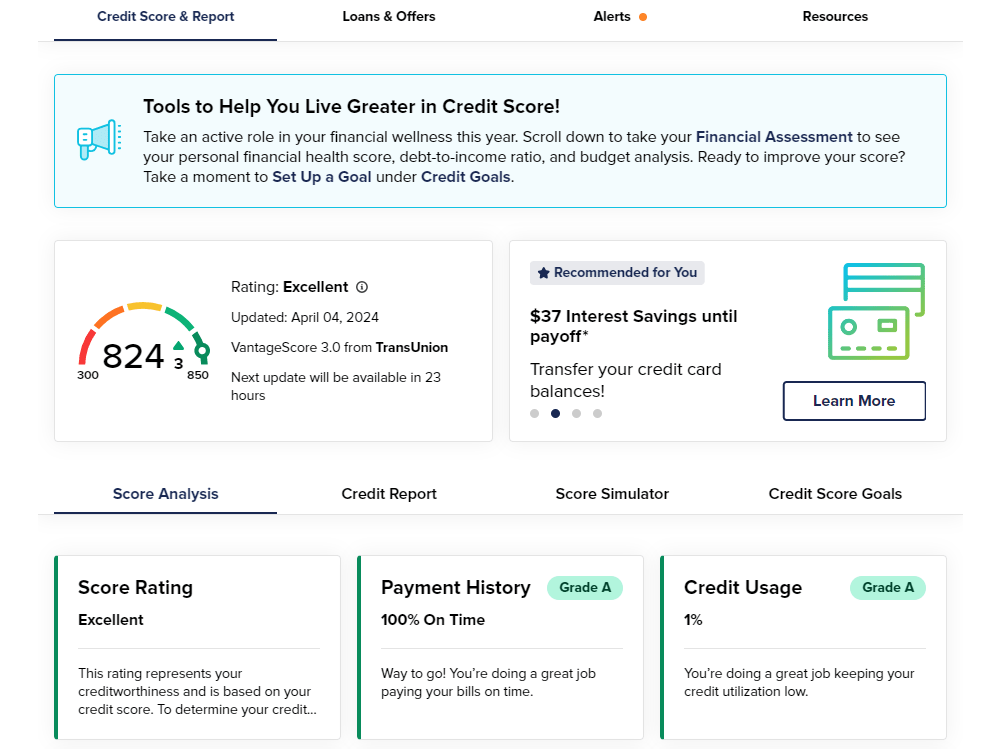

CFCU’s goal is to help members achieve financial success while providing the best and most up-to-date financial resources. We’re excited to offer SavvyMoney through Online Banking and the CFCU Mobile app, allowing CFCU members to check their credit score at any time, right from their phone or computer! SavvyMoney is free and is a great resource to help you monitor your credit report and improve your credit score.

SavvyMoney FAQs

Who can access SavvyMoney?

Any CFCU member can access SavvyMoney within the CFCU Mobile App or in Online Banking, regardless of if you have a credit card or not! Not a member? Sign up here!

Is there a fee to use SavvyMoney?

Nope! SavvyMoney is completely free for CFCU members who are enrolled in online banking. Log in as often as you’d like to check your credit score.

How often is my credit score updated?

As long as you are a regular mobile app or online banking user, your credit score will be automatically updated monthly and displayed when you log in. You can click “refresh score” as frequently as every day, if you wish.

How does the SavvyMoney credit score differ from other credit scoring offerings?

SavvyMoney pulls your credit profile from TransUnion, one of the three major credit reporting bureaus, and uses VantageScore 3.0, a credit scoring model developed collaboratively by the three major credit bureaus: Equifax, Experian, and TransUnion. This model seeks to make score information more uniform between the three bureaus to provide consumers a better picture of their credit health.

Why do credit scores differ?

There are three major credit reporting bureaus – Equifax, Experian and TransUnion – and two scoring models – FICO and VantageScore – that determine credit scores. Financial institutions use different bureaus, as well as their own scoring models. Over 200 factors of a credit report may be taken into account when calculating a score and each model may weight credit factors differently, so no scoring model is completely identical. No matter what credit bureau or credit scoring model is used, consumers do fall into specific credit ranges:

A+ 730 – 850

A 680 – 729

B 640 – 679

C 600 – 639

D 550 – 599

E 549 and below

Will CFCU use the SavvyMoney credit score to make loan decisions?

No, CFCU uses its own lending criteria for making loan decisions.

Will accessing SavvyMoney ‘ping’ my credit and potentially lower my score?

Nope! Checking SavvyMoney is a “soft inquiry,” which does not affect your credit score. Lenders use ‘hard inquiries’ to make decisions about your credit worthiness when you apply for loans.

Does SavvyMoney offer credit report monitoring, as well?

It sure does. SavvyMoney will monitor and send email alerts when there’s been a chance to your credit profile.

How does SavvyMoney keep my financial information secure?

SavvyMoney uses bank level encryption and security measures to keep your data safe and secure. Your personal information is never shared with or sold to a third party.

There is a section in SavvyMoney that features CFCU product offers. Why am I seeing this?

You may receive CFCU offers on loans or services that may be of interest to you and could provide you opportunities to save money.