Pick the Checking Account that's Right for You

Enjoy free checking with awesome perks from Communication Federal Credit Union. Choose from Pay Me Checking with cash-back rewards or Performance Checking with 5.00% APY^.

Pay Me

Checking

Earn $0.10 Cash Back on Qualifying Debit Card Purchases*

$0 Monthly Service Fee

$25 Minimum Opening Deposit

No Monthly Balance Requirement

Free Debit/ATM Card(s)

Access to 16,000 No Fee ATMs

Quarterly Double Reward Categories

Remote Check Deposit

Free eStatements

Honor Pay Overdraft Protection²

Performance

Checking

Earn 5.00% APYˆ on Balances up to $30,000**

$0 Monthly Service Fee

$25 Minimum Opening Deposit

No Monthly Balance Requirement

Free Debit/ATM Card(s)

Access to 16,000 No Fee ATMs

1st Box of Checks Free¹

Remote Check Deposit

Free eStatements

Honor Pay Overdraft Protection²

Plus+

Checking

Earn Interest*** and Enjoy Exclusive Benefits

$4 Monthly Service Fee (Can be Waived)

$25 Minimum Opening Deposit

No Monthly Balance Requirement

Free Debit/ATM Card(s)

Access to 16,000 No Fee ATMs

1st Box of Checks Free¹

Remote Check Deposit

Free eStatements

Honor Pay Overdraft Protection²

| Are You a College Student? »

We offer free Student Checking! |

| Looking for Something Simple? »

Check out the CFCU Connect Card. |

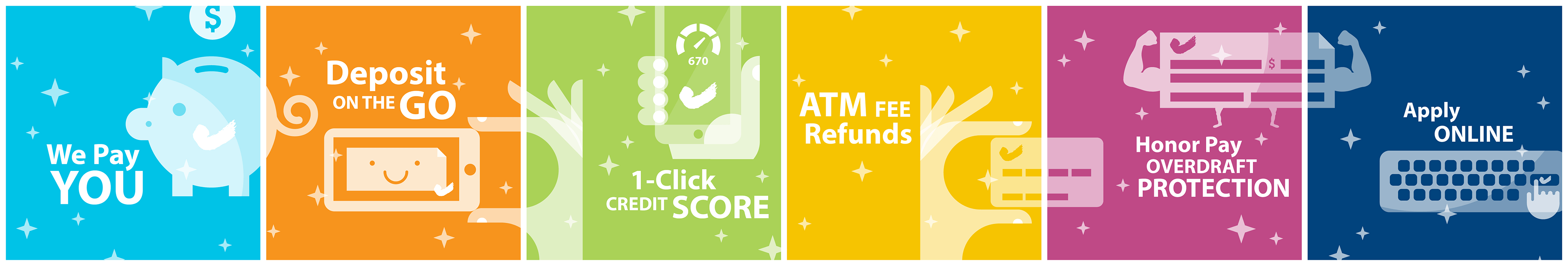

Perks? We've Got Them!

Online Banking

Free Credit Score

Remote Deposit

Free ATM Access

Choose Your Debit Card Design!

Disclosures

ˆ APY = Annual Percentage Yield

* Pay Me Checking Disclosures:

To qualify for PayMe cash back rewards and ATM fee refunds, you must use your PayMe Checking account to meet all of the following qualifications during each calendar month.

- Receive electronic deposits totaling at least $500.

- Electronic deposits include direct deposits, ATM deposits, mobile deposits, and electronic transfers from another financial institution.

- Enroll in and receive eStatements.

Purchases made with a debit card linked to a Pay Me checking account must be a minimum of $10.00 in order qualify for the $.10 swipe reward.

** Performance Checking Disclosures:

To qualify for the reward rate, you must use your Performance Checking account to meet all of the following qualifications during each qualification cycle.

- Make a minimum of 12 debit card purchases (excluding ATM transactions) totaling at least $500. (Posted during each qualification cycle.)

- Receive electronic deposits totaling at least $1,500. (Posted during each qualification cycle.)

- Electronic deposits include direct deposits, ATM deposits, mobile deposits, and electronic transfers from another financial institution.

- Have at least one ACH automatic debit transaction. (Posted during each qualification cycle.)

- Enroll in and receive eStatements.

(1) Balances up to $30,000 receive APY of 5.00%; and (2) balances over $30,000 earn 0.10% interest rate on portion of balance over $30,000, resulting in 5.00% – 0.10% APY depending on the balance.

If qualifications are not met, all balances earn 0.10% APY.

Qualifying transactions must post to and settle account during monthly qualification cycle. Transactions may take one or more business days from the date transaction was made to post to an account. ATM-processed transactions do not count towards qualifying debit card purchases.

“Monthly Qualification Cycle” means a period beginning on the 25th day of the month and ending on the 24th day of the following month. Transfers between accounts do not count as qualifying transactions. Fees may reduce earnings.

*** Plus Checking Disclosures:

Interest rate may vary. See our Rates page for most current interest rate information.

Monthly fee waived with $500 per month direct deposit or if $750 is maintained on deposit in a CFCU Savings, Share Certificate or Share Draft/Checking account.

General Disclosures:

¹ The first box of CFCU Branded checks is free.

² To receive Honor Pay, your account must be maintained in good standing. Direct deposit of at least $500 must be maintained for two consecutive months.