Welcome to the Money Fit for Life Resource Center

Are you struggling with finances? Could you use a little help understanding more about building good credit or setting up a budget? Well, we can help. We’ve assembled some of our top tips and resources to better help our members.

Credit

Understanding credit scores and what impacts your score can be a bit of a mystery. That’s why we’ve provided an easy-to-understand overview of what comprises your score and some tips for improving your score.

Ways to Improve Your Score

- Pay off or pay down credit cards

- Do not close cards because capacity may decrease

- Move revolving debt to installment debt

- Make payments on time (older late pays become less significant)

- Slow down opening of new accounts

- Acquire a solid credit history with years of experience

Things That Hurt Your Score

- Missing payments (regardless of amount, it can take 24 months to restore credit with one late payment)

- Credit cards at capacity (i.e. maxing out credit cards)

- Shopping for credit excessively

- Opening numerous credit accounts in a short timeframe

- Having more revolving debts in relation to installment debts

- Closing credit cards (this could lower available capacity)

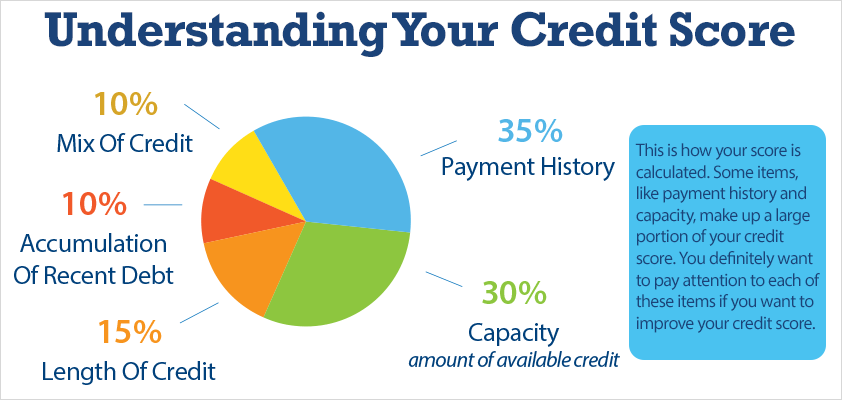

What Makes Your Score?

- 35% = Based on payment history (i.e. on-time or delinquent)

- More weight on current pay history

- 30% = Capacity (capacity is king)

- 15% Length of credit

- 10% Accumulation of debt in the past 12-18 months

- Number of inquiries and opening dates

- 10% Mix of credit

- Installment (can raise) vs. revolving (can lower)

- Finance company loans can lower your score

Range of Scores: (These ranges will vary by Lender)

- 850 – 730 = A+ (Excellent)

- 729 – 680 = A

- 679 – 640 = B

- 639 – 600 = C

- 599 – 550 = D

- 549 and Below = E

Approximate Credit Weight for Each Year:

- 40% = current to 12 months

- 30% = 12 – 24 months

- 20% = 25 – 36 months

- 10% = 37+ months

We hope you find this information helpful! You can also download a copy of our free workshop for improving your credit by clicking the link below.

Download “Get Your Credit Back on Track” free pdf presentation >>

Budget

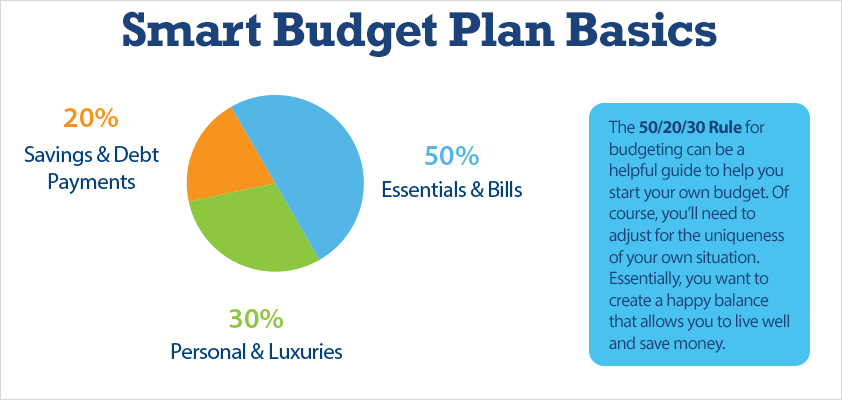

Smart budgeting means smart spending and saving. There are lots of different methods, but the basics are easy to understand. When crafting your budget, start simply, by embracing the 50/20/30 Rule. This simple budget is a great starting point. It allocates your income into three categories. Each category needs to roughly maintain the percentages listed below, although there is certainly room for flexibility.

50/20/30 Rule

- 50% of your monthly income should be set aside to pay for bills and essential items

- 30% can be set aside for luxuries and non-essential expenses

- 20% should be used to pay down debt and invest in savings

How to Set Up Your Budget

- Add up your monthly bills and re-occurring expenses

- Add up your monthly income, including any additional re-occurring money you receive

- Subtract the difference to get an assessment of your current financial budget (How can you adjust it to fit the 50/20/20 Rule?)

- Cut unnecessary expenses, set money aside for savings and limit expenditures

- Track your budget each month and adjust accordingly

Why You Need a Budget

- Allows you to have control over what you spend

- Planning for the future (financial goals & savings)

- Peace of mind, without the need to worry constantly about money

- A more comfortable lifestyle

Budget Best Practices

- Prioritize your needs vs. your wants

- Pay yourself by putting money in savings first, before you spend it

- Allocate a fun budget so that you can stick to your budget without feeling deprived

- Live within your means

- Stick to your budget

Budget Tips & Tricks

- Brown-bag lunches at work vs. eating out

- Potlucks and game nights

- Frugal gift giving

- Shop for online deals, discounts and coupons

- Bike or carpool to work

- Cut back on your vices — they’re expensive and bad for you!

- Grow your own food with a garden

- Get rid of unnecessary expenses like expensive cable packages, extra vehicles you don’t need, expensive cell phone packages, updating to the latest devices

- Refinance your mortgage if rates are lower than your current rate

Debt

Does the amount of debt you owe seem overwhelming at the moment? We have a few tips to help you get a handle on the situation.

Debt Tips

- Make a list of all of your debt, including the interest charges

- Pay down your most expensive debt first

- Pay down credit cards, since maxed out capacity can hurt your credit score

- Pay more than your minimum payments

- Transfer high interest credit card balances to one low-interest card

- Don’t create more debt

It’s never too late to improve your financial health!

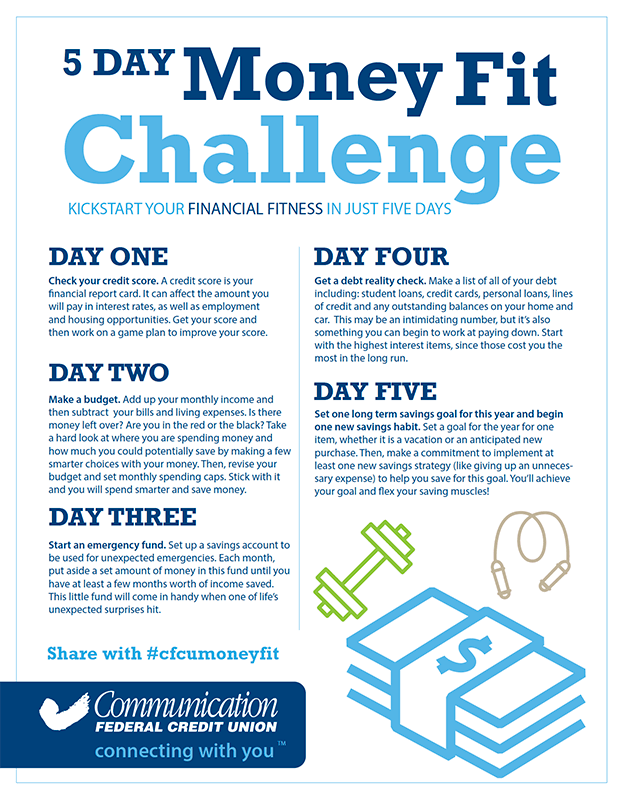

Communication Federal Credit Union can help. We’ve mapped out 5 simple ways to kickstart your money fitness plan. It’s simple. Take our 5 day challenge and flex your money muscles!

Download the Money Fit Challenge (pdf)

Download the Money Fit Challenge (pdf)

Take the 5 Day Challenge and share your success stories with us on social media with the hashtag #CFCUMoneyFit. Need extra help? One of our financial fitness coaches will be sure to contact you.